[ ]

| (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (4) Proposed maximum aggregate value of transaction: (5) Total Fee Paid: [_] Fee paid previously paid with preliminary materials. |

[ ]

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)0- 11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1)

| Amount previously paid:____________________________

|

| (2)

| Form, schedule or registration statement no.:____________

|

| (3)

| Filing party:______________________________________

|

| (4)

| Date filed: _______________________________________

|

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

BNY MELLON APPRECIATION FUND, INC.

BNY MELLON TAX MANAGED GROWTH FUND

BNY MELLON WORLDWIDE GROWTH FUND, INC

c/o BNY Mellon Investment Adviser, Inc.

The Dreyfus Family of Funds

200 Park Avenue

New York, New York 10166

Dear Shareholder:

Your Dreyfus fund(s) and certain other funds

Time is running out to participate in the Dreyfus Family of Funds will hold a special joint meeting of shareholders on February 8, 2012. Shareholders of certain funds will be asked to elect an additional Board member of their fund and, in the case of certain funds, elect three Board members who have been appointed by their fund’s Board and serve as current Board members of the fund, but whose election has not been proposed to shareholders until now. The enclosed proxy statement describes the nominees’ qualifications and each of their respective current roles overseeing funds in the Dreyfus Family of Funds. Please take the time to read the enclosed materials.

Because the proposal to elect Board members is common to these funds, we have combined the proxy statement. If you own shares of more than one of these Dreyfus funds, the combined proxy statement may save you the time of reading more than one document before you vote. If you own shares of more than one of these funds on the record date for the meeting, please note thateach fund has a separate proxy card. You should vote one for each fund in which you own shares.

Remember, your vote is extremely important, no matter how large or small your fund holdings. By voting promptly, you can help avoid additional costs that are incurred with follow-up letters and calls.

To vote, you may use any of the following methods:

By Mail.Please complete, date and sign the enclosed proxy card for each fund in which you own shares and mail itin the enclosed, postage-paid envelope.

By Internet.Have your proxy card(s) available. Go to the website listed on the proxy card. Enter your control numberfrom your proxy card. Follow the instructions on the website.

By Telephone.Have your proxy card(s) available. Call the toll-free number listed on the proxy card. Enter yourcontrol number from your proxy card. Follow the recorded instructions.

In Person.Any shareholder who attends the meeting in person may vote by ballot at the meeting.

We encourage you to vote through the Internet or by telephone using the number that appears on your proxy card(s). If you later decide to attend the meeting, you may revoke your proxy and vote your shares in person at the meeting. Whichever voting method you choose, please take the time to read the full text of the proxy statement before you vote.

Your vote is very important to us. If you have any questions before you vote, please call one of the Dreyfus service representatives at 1-800-DREYFUS. Thank you for your response and for your continued investment with the Dreyfus Family of Funds.

Bradley J. Skapyak

President

The Dreyfus Family of Funds

The Dreyfus/Laurel Funds, Inc.

The Dreyfus/Laurel Funds Trust

The Dreyfus/Laurel Tax-Free Municipal Funds

Dreyfus Investment Funds

Dreyfus Funds, Inc.

Notice of Special Joint Meeting of Shareholders

To Be Held on February 8, 2012

To the Shareholders:

A Special Joint Meeting of Shareholders of each of the Dreyfus Funds listed aboveabove-named funds (each, a “Fund” and collectively,"Fund"), scheduled for October 4, 2022. Each Fund's shareholders need to approve a new sub-investment advisory agreement with Fayez Sarofim & Co. ("Sarofim & Co.") in order to ensure that Sarofim & Co. can continue to provide uninterrupted services as the “Funds”)*sub-adviser to each Fund.

The shareholder meeting will be held at the offices of The Dreyfus Corporation, 200 Park Avenue, 8th Floor, New York, New York 10166, on Wednesday, February 8, 2012October 4, 2022 at 10:3000 a.m., for the following purposes:

|

1. To elect Board members to hold office until their successors are duly elected and qualified. |

2. To transact such other business as may properly come before the meeting, or any adjournment or adjourn- |

ments thereof. |

Shareholders of record at the close of business on November 1, 2011 will be entitled to receive notice of and to vote at the meeting.

By Order of the Boards

New York, New York

November 17, 2011

|

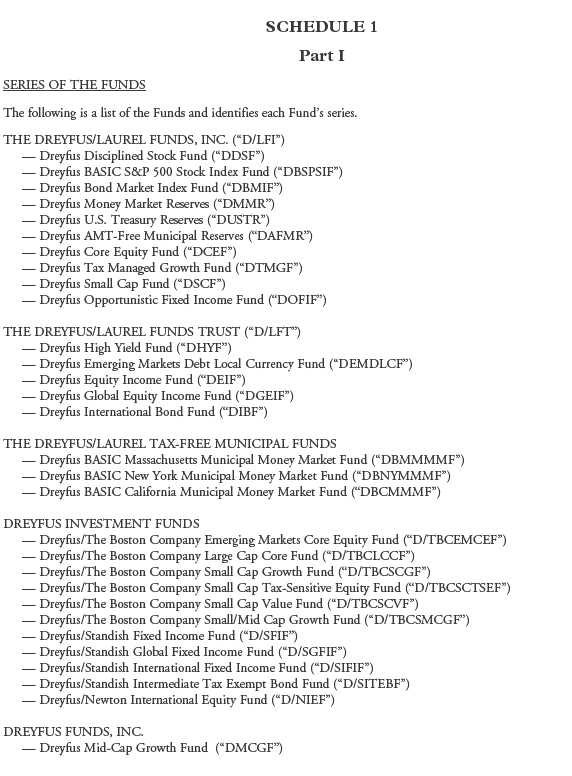

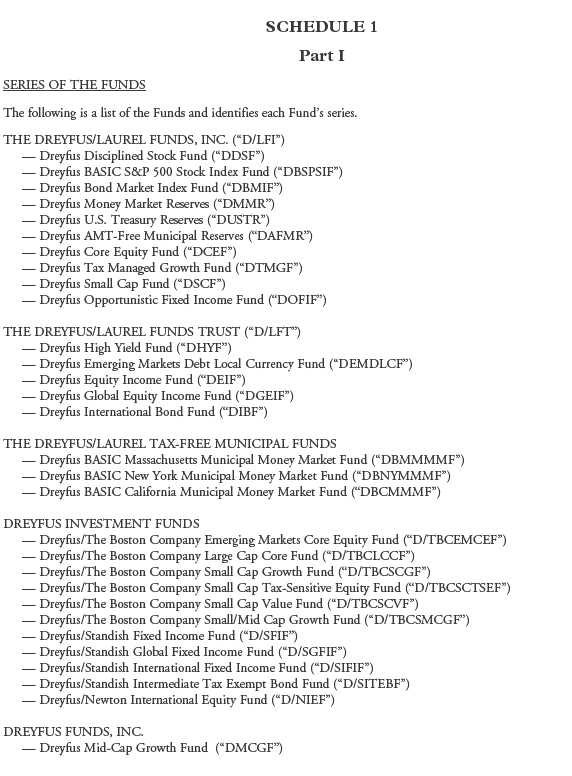

* Each Fund is a “series” investment company comprised of separate portfolios. For a list of each Fund’s series, see Schedule 1 to the proxy |

statement. Shareholders of each series of a Fund will vote as a single class on the proposal to elect Board members for the respective Fund. |

Eastern Time. The Dreyfus/Laurel Funds, Inc.

The Dreyfus/Laurel Funds Trust

The Dreyfus/Laurel Tax-Free Municipal Funds

Dreyfus Investment Funds

Dreyfus Funds, Inc.

COMBINED PROXY STATEMENT

Special Joint Meeting of Shareholders

to be held on February 8, 2012

This proxy statement is furnished in connection with a solicitation of proxies by each of the respective Boards of The Dreyfus/Laurel Funds, Inc. (“D/LFI”), The Dreyfus/Laurel Funds Trust (“D/LFT”), The Dreyfus/Laurel Tax-Free Municipal Funds (“D/LT-F”), Dreyfus Investment Funds (“DIF”) and Dreyfus Funds, Inc. (“DFI”) (each, a “Fund” and, collectively, the “Funds”)* to be used at the Special Joint Meeting of Shareholders (the “Meeting”) of each Fund to be held on Wednesday, February 8, 2012 at 10:30 a.m., at the offices of The Dreyfus Corporation (“Dreyfus”), 200 Park Avenue, 8th Floor, New York, New York 10166, for the purposes set forth in the accompanying Notice of Special Joint Meeting of Shareholders. Shareholders of record at the close of business on November 1, 2011 are entitled to receive notice of and to vote at the Meeting. Shareholders are entitled to one vote for each Fund share held and fractional votes for each fractional Fund share held. Shareholders can vote only on matters affecting the Fund(s) of which they are shareholders. Shares represented by executed and unrevoked proxies will be voted in accordance with the specifications made thereon. If any enclosed form of proxy is executed and returned, it nevertheless may be revoked by another proxy, by calling the toll-free telephone number, through the Internet or by letter directed to the relevant Fund, which must indicate the shareholder’s name and account number. To be effective, such revocation must be received before the Meeting. In addition, any shareholder who attends the Meeting in person may vote by ballot at the Meeting, thereby canceling any proxy previously given.

Shareholders of each Fund will vote as a single class (which includes all series of a Fund) and will vote separately from the shareholders of each other Fund on the election of Board members. It is essential that shareholders who own shares in more than one Fund complete, date, sign and return, or otherwise provide voting instructions with respect to,eachproxy card they receive.

Information as to the number of shares outstanding and share ownershipnew sub-investment advisory agreement for each Fund is set forth on Schedule 1 to this proxy statement.

The principal executive offices of each Fund are located at 200 Park Avenue, New York, New York 10166. Copies of each Fund’s most recent Annual and Semi-Annual Reports are available upon request, without charge, by writingsubstantially similar in material respects to the Fund at 144 Glenn Curtiss Boulevard, Uniondale, New York 11556-0144, or by calling toll-free 1-800-DREYFUS.

IMPORTANT NOTICE REGARDING INTERNET

AVAILABILITY OF PROXY MATERIALS

THIS PROXY STATEMENT AND COPIES OF EACH FUND’S MOST RECENT ANNUAL REPORT TO SHAREHOLDERS ARE AVAILABLE AT

HTTP://WWW.DREYFUS.COM/PROXYINFO.HTM.

* | Each Fund is a “series” investment company comprised of separate portfolios. For a list of each Fund’s series, see Schedule 1 to this proxy statement. Shareholders of each series of a Fund will vote as a single class on the proposal to elect Board membersprior sub-investment advisory agreement for the respective Fund.

|

PROPOSAL: ELECTION OF BOARD MEMBERS

With respect D/LFI, D/LFT and D/LT-F, it is proposed that shareholders consider the election of Francine J. Bovich as an additional Board member of their Fund and also consider the election of Joseph S. DiMartino and Benaree Pratt Wiley, current Board members of these Funds not previously proposed to shareholders of the Funds, until now. With respect to DIF and DFI, it is proposed that shareholders consider the election of Ms. Bovich, a current Board member of these Funds not previously proposed to shareholders of the Funds, until now. Ms. Bovich, Ms. Wiley and Mr. DiMartino (the “Nominees”) were selected and nominated by those members of the present Boards of the Funds who are not “interested persons” of the Funds (“Independent Board members”), as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), after recommendation by one or more Independent Board members. The Nominees also currently serve as Board members of other funds in the Dreyfus Family of Funds. Ms. Wiley and Mr. DiMartino were elected by shareholders of DIF effective December 2008 and by shareholders of DFI effective September 2009. Mr. DiMartino currently serves as Chairman of the Board of each Fund and each Fund’s investment strategy, management policies, sub-investment advisory fee and portfolio managers (with the exception of Mr. Fayez Sarofim, whose passing caused a "change in control" of Sarofim & Co., which triggered an assignment and automatic termination of each Fund's then-existing sub-investment advisory agreement with Sarofim & Co., resulting in the temporary implementation of an interim sub-investment advisory agreement) will not change in connection with the implementation of the other funds innew sub-investment advisory agreement. BNY Mellon Investment Adviser, Inc. will continue to serve as each Fund's investment adviser.

WHAT DO WE NEED FROM YOU? In order to ensure that Sarofim & Co. can continue to provide uninterrupted services as the Dreyfussub-adviser to each Fund, shareholders need to approve the new sub-investment advisory agreement at the shareholder meeting. Please also note that each Fund’s shareholder base is made up of thousands of investors just like yourself, which makes your vote even more important no matter how many shares you own. Accordingly, your vote is critical to the approval of this proposal.

For further information about the shareholder meeting, the proposal and how to vote or to obtain a copy of the Joint Proxy Statement, you can reach us at 800-515-4479 between the hours of 9:00 a.m. and 10:00 p.m., Eastern Time, Monday through Friday and Saturday 10:00 a.m. to 6 p.m., Eastern Time.

We greatly appreciate your consideration and investment with the BNY Mellon Family of Funds. Each Nominee has consented to being named in this proxy statement and has agreed to serve as a Board member

Sincerely,

/s/ David DiPetrillo

David DiPetrillo

President

BNY Mellon Family of the Funds if elected. Biographical information about each Nominee is set forth below. Biographical information about each Fund’s current Board members who are not Nominees, information on each Nominee’s and current Board member’s ownership of shares of the Funds, and other relevant information is set forth on Exhibit A to this proxy statement.

The persons named as proxies on the enclosed proxy card(s) will vote for the election of the Nominees unless authority to vote for any or all of the Nominees is withheld in the proxy. Each Nominee elected will serve as an Independent Board member of the relevant Fund and until his or her successor is duly elected and qualified. It is not contemplated that any Nominee will be unable to serve as a Board member for any reason, but if that should occur prior to the Meeting, the proxy holders will vote for such other nominee or nominees as the Funds’ Independent Board members may recommend. Independent board members of investment companies play a critical role in overseeing fund operations and policing potential conflicts of interest between the fund and its investment adviser and other service providers.

The following tables present information about the Nominees, including their principal occupations, other board memberships for the past five years and when they first became a Board member of a Fund. The address of each Nominee is c/o The Dreyfus Corporation, 200 Park Avenue, 8th Floor, New York, New York 10166.

| | | | |

| Name of Nominee (Age) | | Principal Occupation | Other Public Company Board |

| Position with Funds (Since) | | During Past 5 Years | Memberships During Past 5 Years |

| JOSEPH S. DiMARTINO (68) | | Corporate Director and Trustee | Board member of 76 funds (192 |

| Chairman of the Board and Nominee | | | portfolios) in The Dreyfus Family |

D/LFI | (1999 | ) | | of Funds |

D/LFT | (1999 | ) | | CBIZ (formerly, Century Business |

D/LT-F | (1999) | | | Services, Inc.), a provider of |

DIF | (2008 | ) | | outsourcing functions for small and |

DFI | (2009 | ) | | medium size companies,Director |

| | | | (1997 – present) |

| | | | The Newark Group, a provider of a |

| | | | national market of paper recovery |

| | | | facilities, paperboard mills and |

| | | | paperboard converting plants, |

| | | | Director(2000 – 2010) |

| | | | Sunair Services Corporation, a |

| | | | provider of certain outdoor-related |

| | | | services to homes and businesses |

| | | | Director(2005 – 2009) |

2

| | | | | |

| Name of Nominee (Age) | Principal Occupation | | Other Public Company Board |

| Position with Funds (Since) | During Past 5 Years | | Memberships During Past 5 Years |

| BENAREE PRATT WILEY (65) | Principal, The Wiley Group, a firm | | CBIZ (formerly, Century Business |

| Board member and Nominee | specializing in strategy and business | | Services, Inc.), a provider of out- |

D/LFI | (1998) | development (2005 – present) | | sourcing functions for small and |

D/LFT | (1998) | | | medium size companies,Director |

D/LT-F | (1998) | | | (2008 – present) |

DIF | (2008) | | | |

DFI | (2009) | | | |

|

| FRANCINE J. BOVICH (60) | Trustee, The Bradley Trusts, private | | N/A |

| Board member and Nominee | trust funds (2011 – present) | | |

DIF | (2011) | Managing Director, Morgan Stanley | | |

DFI | (2011) | Investment Management | | |

| | (1993 – 2010 | ) | |

Each

MUTUAL FUND SERVICES

Shareholder Name

Address 1

Address 2

Address 3

BNY MELLON INVESTMENT MANAGEMENT

Re: “FUND NAME HERE

Dear Shareholder:

We have tried unsuccessfully to contact you, whether by mail or by phone, regarding a very important matter concerning your investment in the “Fund typically pays its Board members its allocated portion ofName Here”. This matter pertains to an annual retainer and a fee per meeting attendedimportant operating initiative for the Funds and reimburses them for their expenses. Each Fund also pays its Emeritus Board members its allocated portion of an annual retainer and a fee per meeting attended for the Funds. For information on the amount of compensation paid to each current Board member by a Fund for the Fund’s last fiscal year,which we need your consideration and paid by all funds in the Dreyfus Family of Funds for which such person was a Board member for the year ended December 31, 2010, see Exhibit Aresponse. The deadline to this proxy statement.hear from you is 10:00 a.m. Eastern Time on October 3, 2022.

The current Board members of each Fund are responsible for overseeing management

It is very important that we speak to you regarding this matter. Please call toll-free at (800) 515-4479between 9:00 a.m. and 10:00 p.m. Eastern Time, Monday through Friday, or 10:00 a.m. to 6:00 p.m. Eastern Time on Saturday. At the time of the Funds. For morecall, please reference the Investor ID listed below.

INVESTOR PROFILE:

Investor ID: 123456789 Security ID: 123456789

Shares owned: 33,333.00 Household ID: 0000000

There is no confidential information on the Board’s oversight role as well as its composition and leadership structure, see Exhibit A to this proxy statement.

Each Fund has a standing audit and nominating committee, each of which is comprised of the Fund’s Independent Board members. Each Fund also has a standing compensation committee comprised of Ms. Roslyn M. Watson (Chair), Mr. James M. Fitzgibbons and Ms. Wiley. For information on the number of committee meetings held during each Fund’s last fiscal year, see Exhibit A to this proxy statement.

The function of each Fund’s audit committee is to (i) oversee the Fund’s accounting and financial reporting processesrequired and the auditscall will only take a few moments of the Fund’s financial statements and (ii) assist in the Board’s oversight of the integrity of the Fund’s financial statements, the Fund’s compliance with legal and regulatory requirements and the independent registered public accounting firm’s qualifications, independence and performance.

Each Fund’s nominating committee is responsible for selecting and nominating persons for election or appointment by the Board and for election by shareholders. In evaluating potential nominees, including any nominees recommended by shareholders, the committee takes into consideration various factors listed in the nominating committee charter, including character and integrity and business and professional experience. The Committee may consider whether a potential nominee’s professional experience, education, skills and other individual qualities and attributes, including gender, race or national origin, would provide beneficial diversity of skills, experience or perspective to the Board’s membership and collective attributes. Such considerations will vary based on the Board’s existing membership and other factors, suchyour time. Please contact us as the strength of a potential nominee’s overall qualifications relative to diversity considerations. The nominating committee will consider recommendations for nominees from shareholders submitted to the Secretary of the Fund, c/o The Dreyfus Corporation Legal Department, 200 Park Avenue, 8th Floor East, New York, New York 10166, which include information regarding the recommended nomineesoon as specified in the nominating committee charter. A copy of the Funds’ nominating committee charter is not available on the Funds’ or Dreyfus’ website, but is attached as Exhibit B to this proxy statement.possible.

3

The function of the compensation committee is to establish the appropriate compensation for serving on the Board. Each Fund also has a standing pricing committee comprised of any one Board member. The function of the pricing committee is to assist in valuing the Fund’s investments.

Required Vote

For each Fund other than DFI, the election of a Nominee requires the affirmative vote of a plurality of votes cast at the Meeting for the election of Board members of the Fund. For DFI, the election of a Nominee requires the affirmative vote of a majority of the shares present at the Meeting in person or by proxy.

ADDITIONAL INFORMATION

Selection of Independent Registered Public Accounting Firm

The 1940 Act requires that each Fund’s independent registered public accounting firm be selected by a majority of the Independent Board members of the Fund. One of the purposes of each Fund’s audit committee is to recommend to the Fund’s Board the selection, retention or termination of the independent registered public accounting firm for the Fund. Each Fund’s audit committee recommended, and each Fund’s Board, including a majority of its Independent Board members, approved, the selection of KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund’s current fiscal year. A representative of KPMG is expected to be present at the Meeting and will have an opportunity to make a statement (if the representative so desires) and to respond to appropriate questions.

PricewaterhouseCoopers LLP (“PwC”), an independent registered public accounting firm, was the independent registered public accounting firm for DIF for the fiscal year ended September 30, 2008 and December 31, 2008. At meetings held on February 9-10, 2009, the audit committee and the Board of DIF engaged KPMG to replace PwC as the independent registered public accounting firm for the Fund. During the Fund’s two most recent fiscal years and subsequent interim periods prior to their replacement: (i) no report on the Fund’s financial statements contained an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope, or accounting principles; and (ii) there were no “disagreements” (as such term is used in Item 304 of Regulation S-K) with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of PwC, would have caused it to make reference to the subject matter of the disagreement(s) in connection with its report. PwC has performed no auditing procedures subsequent to February 27, 2009 with respect to any financial statements of DIF.

Ernst &Young LLP (“E&Y”), an independent registered public accounting firm, was the independent registered public accounting firm for DFI for the fiscal year ended December 31, 2009. At a meeting held on February 9, 2010, the audit committee and the Board of DFI engaged KPMG to replace E&Y as the independent registered public accounting firm for the Fund. During the Fund’s two most recent fiscal years and subsequent interim period prior to their replacement: (i) no report on the Fund’s financial statements contained an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope, or accounting principles; and (ii) there were no “disagreements” (as such term is used in Item 304 of Regulation S-K) with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of E&Y, would have caused it to make reference to the subject matter of the disagreement(s) in connection with its report. E&Y has performed no auditing procedures subsequent to February 25, 2010 with respect to any financial statements of DFI.

Information regarding the audit and non-audit fees that the Funds were charged by their independent registered public accounting firms in the Funds’ last two fiscal years is set forth in Exhibit A to this proxy statement.

4

Investment Adviser, Distributor and Transfer Agent

The investment adviser for each Fund is Dreyfus, 200 Park Avenue, New York, New York 10166. Founded in 1947, Dreyfus manages approximately $268 billion in 192 mutual fund portfolios. Dreyfus is the primary mutual fund business of The Bank of New York Mellon Corporation (“BNY Mellon”), a global financial services company focused on helping clients move and manage their financial assets, operating in 36 countries and serving more than 100 markets. BNY Mellon is a leading provider of financial services for institutions, corporations and high-net-worth individuals, providing asset and wealth management, asset servicing, issuer services, and treasury services through a worldwide client-focused team. BNY Mellon has $26.3 trillion in assets under custody and administration and $1.3 trillion in assets under management, and it services more than $11.8 trillion in outstanding debt. Additional information is available atwww.bnymellon.com.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus with principal offices at 200 Park Avenue, New York, New York 10166, serves as each Fund’s distributor.

Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus with principal offices at 200 Park Avenue, New York, New York 10166, serves as each Fund’s transfer and dividend disbursing agent.

Voting Information

Each Fund will bear its pro rata share of the cost of soliciting proxies based on the net assets of the Fund. In addition to the use of the mails, proxies may be solicited personally or by telephone, and Dreyfus may pay persons holding Fund shares in their names or those of their nominees for their expenses in sending soliciting materials to their principals. The Funds may retain proxy solicitors to assist in the solicitation of proxies primarily by contacting shareholders by telephone, which is expected to cost approximately $7,000, plus any out of pocket expenses, such cost to be borne pro rata among the Funds based on their net assets.

Authorizations to execute proxies may be obtained by telephonic or electronically transmitted instructions in accordance with procedures designed to authenticate the shareholder’s identity. In all cases where a telephonic proxy is solicited (as opposed to where the shareholder calls the toll-free number directly to vote), the shareholder will be asked to provide or confirm certain identifiable information and to confirm that the shareholder has received the Fund’s proxy statement and proxy card in the mail. Within 72 hours of receiving a shareholder’s telephonic or electronically transmitted voting instructions, a confirmation will be sent to the shareholder to ensure that the vote has been taken in accordance with the shareholder’s instructions and to provide a telephone number to call immediately if the shareholder’s instructions are not correctly reflected in the confirmation. Shares represented by executed and unrevoked proxies will be voted in accordance with the specifications made thereon, and, if no voting instructions are given, shares will be voted “FOR” the proposal. Any shareholder giving a proxy may revoke it at any time before it is exercised by submitting to the Fund a written notice of revocation or a subsequently executed proxy, by calling the toll-free telephone number or through the Internet, or by attending the Meeting and voting in person.

If a proxy is properly executed and returned accompanied by instructions to withhold authority to vote or represents a broker “non-vote” (that is, a proxy from a broker or nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote Fund shares and the broker or nominee does not have discretionary power to vote on the proposal) (together, “abstentions”), the Fund shares represented thereby will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. Abstentions will not constitute a vote in favor of the proposal.

With respect to Dreyfus-sponsored individual retirement accounts (“IRAs”), the Individual Retirement Custodial Account Agreement governing the IRAs requires The Bank of New York Mellon (“BNYM”), as the custodian of the IRAs, to vote Fund shares held in such IRAs in accordance with the IRA shareholder’s instructions. However, if no voting

5

instructions are received, BNYM may vote Fund shares held in the IRA in the same proportions as the Fund shares for which voting instructions are received from other Dreyfus IRA shareholders. Therefore, if an IRA shareholder does not provide voting instructions prior to the Meeting, BNYM will vote the IRA shares in the same proportions as it votes the shares for which properly conveyed instructions are timely received from other Dreyfus IRA shareholders.

If a quorum is not present at the Meeting for a Fund, the persons named as proxies may propose one or more adjournments of the Meeting with respect to that Fund to permit further solicitation of proxies. Any adjournment will require the affirmative vote of a majority of those shares affected by the adjournment that are represented at the Meeting in person or by proxy. With respect to D/LFI and DFI, 33-1/3% of the Fund’s shares entitled to vote constitute a quorum for the transaction of business at the Meeting. With respect to each of D/LFT and D/LT-F a majority of the Fund’s shares entitled to vote constitute a quorum for the transaction of business at the Meeting. With respect to DIF, 50% of the Fund’s shares entitled to vote constitute a quorum for the transaction of business at the Meeting.

OTHER MATTERS

No Fund’s Board is aware of any other matters which may come before the Meeting. However, should any such matters properly come before the Meeting, it is the intention of the persons named in the accompanying form of proxy to vote proxies in accordance with their judgment on such matters.

Under the proxy rules of the Securities and Exchange Commission (the “SEC”), shareholder proposals meeting requirements contained in those rules may, under certain conditions, be included in the Funds’ proxy materials for a particular meeting of shareholders. One of these conditions relates to the timely receipt by a Fund of any such proposal. Since the Funds do not have regular annual meetings of shareholders, under these rules, proposals submitted for inclusion in the proxy materials for a particular meeting must be received by a Fund a reasonable time before the solicitation of proxies for the meeting is made. The fact that a Fund receives a shareholder proposal in a timely manner does not ensure its inclusion in proxy materials since there are other requirements in the proxy rules relating to such inclusion.

NOTICE TO BANKS, BROKER/DEALERS AND VOTING TRUSTEES

AND THEIR NOMINEES

Please advise the appropriate Fund, in care of Dreyfus Transfer, Inc., P.O. Box 9263, Boston, Massachusetts 02205-8501, whether other persons are the beneficial owners of Fund shares for which proxies are being solicited from you, and, if so, the number of copies of this proxy statement and other soliciting material you wish to receive in order to supply copies to the beneficial owners of shares.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING IN PERSON ARE URGED TO COMPLETE, SIGN, DATE AND RETURN, OR OTHERWISE PROVIDE VOTING INSTRUCTIONS WITH RESPECT TO,EACHPROXY CARD IN THE ENCLOSED STAMPED ENVELOPE.

Dated: November 17, 2011

6

S-1

SCHEDULE 1

Part 2

PERTAINING TO SHARE OWNERSHIP

Set forth below for each Fund is information as to the number of shares of the Fund outstanding and those shareholders known by the Fund, if any, to own of record or beneficially 5% or more of a class of the Fund’s outstanding voting securities (including series thereof) as of November 1, 2011.

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| D/LFI: | | | | |

| DDSF | National Financial Services | 2,441,615.1030 | 13.8765 | % |

| 17,595,279.353 | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| DBSPSIF | Fidelity Investments Institutional | 8,223,859.2960 | 18.9863 | % |

| 43,314,788.332 | Operations, Co. Inc. (FIIOC) As Agent | | | |

| | For Delmar Gardens Enterprises Inc. | | | |

| | 401K Profit Sharing Plan - 10319 | | | |

| | 100 Magellan Way # KW1C | | | |

| | Covington, KY 41015-1999 | | | |

| |

| | Hartford Securities Distributions | 4,118,756.5600 | 9.5089 | % |

| | Company, Inc. | | | |

| | P.O. Box 2999 | | | |

| | Attn.: UIT Operations | | | |

| | Hartford, CT 06104-2999 | | | |

| |

| | SEI Private Trust Company | 6,683,370.2030 | 15.4298 | % |

| | C/O First Hawaiian | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | MAC & Co. | 3,445,060.4080 | 7.9535 | % |

| | Attn.: Mutual Fund Operations | | | |

| | 525 William Penn Place | | | |

| | P.O. Box 3198 | | | |

| | Pittsburgh, PA 15230-3198 | | | |

| |

| | New Mexico 529 | 2,312,452.9330 | 5.3387 | % |

| | The Education Plan Portfolios | | | |

| | Attn.: Molly Hausmann AVP | | | |

| | 6803 S Tuscon Way | | | |

| | Centennial, CO 80112 | | | |

S-2Thank you for your time and consideration.

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DBMIF (BASIC Shares) | | | | |

| 130,439,338.785 | Merrill Lynch | 6,844,769.9260 | 5.2475 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | SEI Private Trust Company | 6,921,092.8100 | 5.3060 | % |

| | C/O The Bank of New York Mellon | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | MAC & Co. | 6,654,253.6580 | 5.1014 | % |

| | Attn.: Mutual Fund Operations | | | |

| | 525 William Penn Place | | | |

| | P.O. Box 3198 | | | |

| | Pittsburgh, PA 15230-3198 | | | |

| |

| | Edward D. Jones & Co. | 31,028,351.6510 | 23.7876 | % |

| | Attn.: Mutual Fund | | | |

| | Shareholder Accounting | | | |

| | 201 Progress Parkway | | | |

| | Maryland Hts, MO 63043-3009 | | | |

| |

| | Brown Brothers Harriman & Co. Cust. | 14,959,104.4300 | 11.4682 | % |

| | For the Texas Tomorrow Funds | | | |

| | Investment Funds Global Dist. Ctr. | | | |

| | 525 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1606 | | | |

| |

| | New Mexico Scholars Edge 529 | 7,891,184.0660 | 6.0497 | % |

| | Investment Funds Global Dist. Ctr. | | | |

| | C/O Brown Brothers Harriman & Co. | | | |

| | 525 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1606 | | | |

| |

| | State Street Bank & Trust Co. Cust. | 14,556,746.6220 | 11.1598 | % |

| | FBO Oregon College Savings Plan | | | |

| | Diverse FI | | | |

| | 350 Winter Street NE, Suite 100 | | | |

| | Salem, OR 97301-3896 | | | |

| |

| | Charles Schwab & Co. Inc. | 7,970,579.3300 | 6.1106 | % |

| | Special Custody Acct. | | | |

| | For the Benefit Customers | | | |

| | Attn.: Mutual Funds | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

S-3Sincerely,

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DBMIF (Investor Shares) | | | | |

| 81,968,674.130 | National Financial Services | 31,586,043.2630 | 38.5343 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | DCGT As Trustee and/or Custodian | 6,738,630.9980 | 8.2210 | % |

| | FBO Superior Officers Council | | | |

| | Attn.: NPIO Trade Desk | | | |

| | 711 High Street | | | |

| | Des Moines, IA 50392-0001 | | | |

| |

| | Reliance Trust Company | 4,539,827.8170 | 5.5385 | % |

| | FBO Women OB/GYN | | | |

| | P.O. Box 48529 | | | |

| | Atlanta, GA 30362-1529 | | | |

| |

| | VRSCO | 7,108,049.4990 | 8.6717 | % |

| | FBO AIGFSB CUST TTEE¨ | | | |

| | FBO VOA of Wisconsin, | | | |

| | 403B 2929 Allen Parkway, A6-20 | | | |

| | Houston, TX 77019-7117 | | | |

| |

| | Charles Schwab & Co. Inc. | 8,207,750.1420 | 10.0133 | % |

| | Reinvestment Acct. | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| DMMR (Investor Shares) | | | | |

| 209,974,359.422 | Pershing LLC | 161,201,745.6600 | 76.7721 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Mellon Financial Corporation | 20,878,130.9700 | 9.9432 | % |

| | Attn.: AIS Operations | | | |

| | Mellon Client Service Center | | | |

| | 500 Ross Street, RM 154-0980 | | | |

| | Pittsburgh, PA 15262-0001 | | | |

| |

| DMMR (Class R) | | | | |

| 88,310,316.300 | National Financial Services Corp. | 6,578,764.8700 | 7.4496 | % |

| | For Exclusive Benefit of Our Customers | | | |

| | Attn.: Mutual Funds Dept., 5th Floor | | | |

| | One World Financial Center | | | |

| | 200 Liberty Street | | | |

| | New York, NY 10281-1003 | | | |

| |

| |

| | S-4 | | | |

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DMMR (Class R)(cont’d) | | | | |

| | Boston & Co. | 61,314,408.3600 | 69.4306 | % |

| | 3 Mellon Bank Center | | | |

| | Pittsburgh, PA 15259-0001 | | | |

| |

| | First Clearing, LLC | 15,207,782.1100 | 17.2208 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| DUSTR (Investor Shares) | | | | |

| 125,610,722.668 | Pershing LLC | 118,109,049.5900 | 94.0278 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| DUSTR (Class R) | | | | |

| 139,900,051.631 | Boston & Co. | 137,826,953.3200 | 98.5182 | % |

| | 3 Mellon Bank Center | | | |

| | Pittsburgh, PA 15259-0001 | | | |

| |

| DAFMR (Investor Shares) | | | | |

| 30,755,997.190 | Pershing LLC | 29,852,994.4100 | 97.0640 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| DAFMR (Class R) | | | | |

| 49,837,364.800 | National Financial Services Corp. | 4,138,833.4300 | 8.3047 | % |

| | For Exclusive Benefit of | | | |

| | Our Customers | | | |

| | Attn.: Mutual Funds Dept., 5th Floor | | | |

| | One World Financial Center | | | |

| | 200 Liberty Street | | | |

| | New York, NY 10281-1003 | | | |

| |

| | Boston & Co. | 44,046,574.0700 | 88.3806 | % |

| | P.O. BOX 534005 | | | |

| | Pittsburgh, PA 15253-4005 | | | |

| |

| DAFMR (Class B) | | | | |

| 237,857,974.990 | Pershing LLC | 46,526,829.4100 | 19.5608 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Janney Montgomery Scott LLC | 36,580,859.8300 | 15.3793 | % |

| | 1801 Market Street | | | |

| | Philadelphia, PA 19103-1675 | | | |

| |

| |

| | S-5 | | | |

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DAFMR (Class B)(cont’d) | | | �� | |

| | Stifel Nicolaus & Co. Inc. | 120,907,431.4100 | 50.8318 | % |

| | For the Exclusive Benefit | | | |

| | of Customers | | | |

| | 500 N Broadway | | | |

| | Saint Louis, MO 63102-2110 | | | |

| |

| | Morgan Keegan & Co. Inc. | 33,842,854.3400 | 14.2282 | % |

| | For the Exclusive Benefit | | | |

| | of Customers | | | |

| | 50 N Front Street | | | |

| | Memphis, TN 38103-1199 | | | |

| |

| DAFMR (BASIC Shares) | | | | |

| 25,890,138.100 | Glenn A. Britt | 6,092,582.6600 | 23.5324 | % |

| | New York, NY 10075-0573 | | | |

| |

| | Paul Goldstein Trustee | 1,314,837.3600 | 5.0785 | % |

| | Paul Goldstein Trust | | | |

| | FBO Paul Goldstein | | | |

| | Boynton Beach, FL 33436-6202 | | | |

| |

| | E Trade Clearing LLC | 1,685,030.8500 | 6.5084 | % |

| | P.O. Box 484 | | | |

| | Jersey City, NJ 07303-0484 | | | |

| |

| | Rosalyn Borg Trustee | 1,417,396.3700 | 5.4747 | % |

| | Top of the Line-Up Revocable Trust | | | |

| | of Rosalyn Borg | | | |

| | Saint Louis, MO 63130-3701 | | | |

| |

| DCEF (Class A) | | | | |

| 7,409,689.250 | UBS WM USA | 1,036,263.3010 | 13.9852 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Pershing LLC | 433,652.2580 | 5.8525 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 1,673,665.5810 | 22.5875 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

S-6

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DCEF (Class A)(cont’d) | | | | |

| | American Enterprise | 464,161.2900 | 6.2642 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| | Charles Schwab & Co. Inc. | 886,477.4920 | 11.9638 | % |

| | Special Custody Acct. | | | |

| | FBO Customers | | | |

| | Attn.: Mutual Fund | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| DCEF (Class B) | | | | |

| 66,071.264 | National Financial Services | 11,768.8850 | 17.8124 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Citigroup Global Markets Inc. | 4,425.1220 | 6.6975 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

| |

| | Pershing LLC | 3,464.2600 | 5.2432 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 12,610.1980 | 19.0858 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 5,372.5710 | 8.1315 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | American Enterprise | 10,340.1300 | 15.6500 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| DCEF (Class C) | | | | |

| 6,205,765.042 | Citigroup Global Markets Inc. | 698,437.3320 | 11.2547 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

S-7

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DCEF (Class C)(cont’d) | | | | |

| | UBS WM USA | 837,933.4730 | 13.5025 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | First Clearing, LLC | 441,342.5030 | 7.1118 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| DCEF (Class I) | | | | |

| 2,017,584.930 | Merrill Lynch | 325,179.8190 | 16.1173 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 598,245.8060 | 29.6516 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | Charles Schwab & Co. Inc. | 866,633.1390 | 42.9540 | % |

| | Reinvestment Acct. | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| | LPL Financial | 166,658.3220 | 8.2603 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DTMGF (Class A) | | | | |

| 5,153,739.268 | National Financial Services | 574,629.9020 | 11.1498 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Pershing LLC | 1,880,880.9660 | 36.4955 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 506,507.2310 | 9.8280 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 352,500.4030 | 6.8397 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| |

| | S-8 | | | |

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DTMGF (Class B) | | | | |

| 42,364.959 | UBS WM USA | 2,328.2800 | 5.4958 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Pershing LLC | 7,111.0810 | 16.7853 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 7,122.9260 | 16.8132 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 2,787.1830 | 6.5790 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | Marion Hart Sekerak | 2,206.1850 | 5.2076 | % |

| | P.O. Box 508 | | | |

| | Davidson, NC 28036-0508 | | | |

| |

| | American Enterprise | 3,542.8390 | 8.3627 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| | LPL Financial | 4,087.2770 | 9.6478 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DTMGF (Class C) | | | | |

| 1,105,847.035 | UBS WM USA | 118,619.0570 | 10.7265 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley & Co. | 78,553.2460 | 7.1034 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Merrill Lynch | 361,416.4860 | 32.6823 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| |

| | S-9 | | | |

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DTMGF (Class C)(cont’d) | | | | |

| | First Clearing, LLC | 197,488.7910 | 17.8586 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| DTMGF (Class I) | | | | |

| 323,862.795 | National Financial Services | 40,765.3170 | 12.5872 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Pershing LLC | 49,791.6430 | 15.3743 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 123,785.2430 | 38.2215 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 60,407.7970 | 18.6523 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | Orchard Trust Co. LLC | 22,196.7100 | 6.8537 | % |

| | FBO Putnam Investments | | | |

| | FBO Rercordkeeping For Various Benefits | | | |

| | 8515 E Orchard Rd. 2T2 | | | |

| | Greenwood Village Co. 80111-5002 | | | |

| |

| DSCF (Class A) | | | | |

| 3,013,300.474 | Fidelity Investments Institutional | 150,766.1870 | 5.0034 | % |

| | Operations, Co. As Agent | | | |

| | For Living in Fulfilling Environments | | | |

| | Profit Sharing Plan - 28164 | | | |

| | 100 Magellan Way # KW1C | | | |

| | Covington, KY 41015-1999 | | | |

| |

| | National Financial Services | 156,171.5450 | 5.1827 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Pershing LLC | 1,079,291.0420 | 35.8176 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

S-10

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DSCF (Class A)(cont’d) | | | | |

| | Merrill Lynch | 406,830.9090 | 13.5012 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | American Enterprise | 197,845.8020 | 6.5658 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| DSCF (Class B) | | | | |

| 23,071.993 | National Financial Services | 3,821.8040 | 16.5647 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Pershing LLC | 3,283.2530 | 14.2305 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 4,239.0350 | 18.3731 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | American Enterprise | 2,055.8010 | 8.9104 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | LPL Financial | 2,005.9100 | 8.6941 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DSCF (Class C) | | | | |

| 489,587.491 | National Financial Services | 34,215.0840 | 6.9886 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Morgan Stanley & Co. | 25,915.0770 | 5.2932 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

S-11

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DSCF (Class C)(cont’d) | | | | |

| | Pershing LLC | 30,934.1740 | 6.3184 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 171,770.6300 | 35.0848 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 47,817.6530 | 9.7669 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | MG Trust Company Custodian | 29,179.3530 | 5.9600 | % |

| | FBO Kreinces, Rollins & Shanker, LLC | | | |

| | 700 17th Street, Suite 300 | | | |

| | Denver, CO 80202-3531 | | | |

| |

| DSCF (Class I) | | | | |

| 1,078,083.355 | Fidelity Investments Institutional | 475,701.8300 | 44.1248 | % |

| | Operations, Co. (FIIOC) As Agent | | | |

| | For Certain Employee Benefit Plans | | | |

| | Profit Sharing Plan - 28164 | | | |

| | 100 Magellan Way # KW1C | | | |

| | Covington, KY 41015-1999 | | | |

| |

| | VRSCO | 436,089.1690 | 40.4504 | % |

| | FBO AIGFSB CUST TTEE¨ | | | |

| | FBO City of Erie, | | | |

| | 401A 2929 Allen Parkway, A6-20 | | | |

| | Houston, TX 77019-7117 | | | |

| |

| DOFIF (Class A) | | | | |

| 2,164,835.057 | Pershing LLC | 248,613.4240 | 11.5076 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 113,774.3720 | 5.2663 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

S-12

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DOFIF (Class A)(cont’d) | | | | |

| | Hasmukh & Chandrika Doshi Trustee | 127,707.9050 | 5.9112 | % |

| | Hasmukh & Chandrika Doshi | | | |

| | Charitable Trust | | | |

| | Fairfield, NJ 07004-1588 | | | |

| |

| | American Enterprise | 707,697.8200 | 32.7574 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | BNY Mellon Corporation | 316,145.5540 | 14.6335 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| DOFIF (Class C) | | | | |

| 371,487.947 | Merrill Lynch | 114,771.9510 | 30.9385 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 74,912.2430 | 20.1937 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | American Enterprise | 69,791.4100 | 18.8133 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| | BNY Mellon Corporation | 25,936.5340 | 6.9916 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| | LPL Financial | 37,507.0930 | 10.1106 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

S-13

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DOFIF (Class I) | | | | |

| 551,890.179 | Merrill Lynch | 126,772.4290 | 23.0182 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 66,217.4740 | 12.0232 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | SEI Private Trust Company | 182,493.1440 | 33.1355 | % |

| | C/O The Bank of New York Mellon | | | |

| | Attn.: Mutual Fund Administrator | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | Standish Tax Exempt LTIP | 77,785.9640 | 14.1237 | % |

| | 201 Washington Street | | | |

| | Boston, MA 02108-4403 | | | |

| |

| | BNY Mellon Corporation | 54,149.8420 | 9.8321 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| D/LFT: | | | | |

| DHYF (Class A) | | | | |

| 53,542,085.924 | UBS WM USA | 3,840,031.6040 | 7.1720 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Pershing LLC | 4,228,264.1320 | 7.8971 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 3,378,293.5360 | 6.3096 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 5,399,228.8070 | 10.0841 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

S-14

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DHYF (Class A)(cont’d) | | | | |

| | American Enterprise | 10,917,447.1190 | 20.3904 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| DHYF (Class B) | | | | |

| 500,719.799 | National Financial Services | 67,217.6920 | 13.4242 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | UBS WM USA | 30,113.8340 | 6.0141 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley and Co. | 27,125.1680 | 5.4172 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Pershing LLC | 97,605.5780 | 19.4931 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | First Clearing, LLC | 59,915.1530 | 11.9658 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | American Enterprise | 41,828.6660 | 8.3537 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| DHYF (Class C) | | | | |

| 19,205,303.663 | UBS WM USA | 1,125,982.1580 | 5.8629 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley and Co. | 1,711,704.3520 | 8.9127 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Merrill Lynch | 7,031,727.5590 | 36.6135 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

S-15

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DHYF (Class C)(cont’d) | | | | |

| | First Clearing, LLC | 3,039,906.3770 | 15.8285 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | American Enterprise | 1,160,251.1690 | 6.0413 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| DHYF (Class I) | | | | |

| 86,211,749.693 | Fidelity Investments Institutional | 5,803,593.7520 | 6.7318 | % |

| | Operations, Co. Inc. (FIIOC) As Agent for | | | |

| | Certain Employee Benefit Plans | | | |

| | 100 Magellan Way # KW1C | | | |

| | Covington, KY 41015-1999 | | | |

| |

| | National Financial Services Co. | 5,378,564.7030 | 6.2388 | % |

| | For the Exclusive Benefit of Our Customers | | | |

| | One World Financial Center | | | |

| | 200 Liberty Street | | | |

| | New York, NY 10281 | | | |

| |

| | Pershing LLC | 7,856,046.2950 | 9.1125 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | SEI Private Trust Company | 54,685,861.7720 | 63.4320 | % |

| | M&T Bank | | | |

| | Attn.: Mutual Funds Administrator | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| DEMDLCF (Class A) | | | | |

| 6,300,105.529 | Citigroup Global Markets Inc. | 355,130.1470 | 5.6369 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

| |

| | UBS WM USA | 1,037,173.2940 | 16.4628 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley and Co. | 656,479.5720 | 10.4201 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | S-16 | | | |

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DEMDLCF (Class A)(cont’d) | | | | |

| | Pershing LLC | 355,323.1190 | 5.6400 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 320,028.7110 | 5.0797 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | American Enterprise | 1,270,163.0920 | 20.1610 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | Charles Schwab & Co. Inc. | 1,171,357.3850 | 18.5927 | % |

| | Reinvestment Account | | | |

| | Attn.: Mutual Funds | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| | LPL Financial | 477,696.9080 | 7.5824 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DEMDLCF (Class C) | | | | |

| 1,665,511.254 | Citigroup Global Markets Inc. | 170,028.3330 | 10.2088 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

| |

| | UBS WM USA | 100,325.0500 | 6.0237 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley and Co. | 222,984.0330 | 13.3883 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Merrill Lynch | 677,273.9730 | 40.6646 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 252,932.9860 | 15.1865 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

S-17

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DEMDLCF (Class I) | | | | |

| 192,404,014.762 | Merrill Lynch | 16,175,090.6420 | 8.4068 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | Strafe & Co. | 88,238,969.5930 | 45.8613 | % |

| | FBO Betty Wiener Spomer | | | |

| | Newark, DE 19714-6924 | | | |

| |

| | Vallee & Co. FBO VA | 11,483,492.5300 | 5.9684 | % |

| | C/O M&I Trust Co. NA | | | |

| | Attn.: Mutual Funds | | | |

| | 11270 W Park Place, Suite 400 | | | |

| | Milwaukee, WI 53224-3638 | | | |

| |

| | Wells Fargo Bank NA | 37,981,875.3740 | 19.7407 | % |

| | P.O. Box 1533 | | | |

| | Minneapolis, MN 55480-1533 | | | |

| |

| DEIF (Class A) | | | | |

| 1,039,724.820 | Pershing LLC | 471,874.1920 | 45.4132 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | American Enterprise | 84,401.2960 | 8.1228 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| DEIF (Class C) | | | | |

| 122,895.331 | Merrill Lynch | 34,002.9730 | 27.6698 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | The Bank of New York Mellon | 18,645.4060 | 15.1727 | % |

| | Custodian for Cathryn A. Sundback | | | |

| | Under IRA Plan | | | |

| | Harvard, MA 01451-1604 | | | |

| |

| | First Clearing, LLC | 8,541.0230 | 6.9502 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

S-18

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DEIF (Class C)(cont’d) | | | | |

| | The Bank of New York Mellon | 7,291.2350 | 5.9332 | % |

| | Custodian for Stephen A. Stecyk | | | |

| | Under IRA Plan | | | |

| | Harvard, MA 01451-1604 | | | |

| |

| | American Enterprise | 18,365.8730 | 14.9452 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | LPL Financial | 6,727.7140 | 5.4747 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DEIF (Class I) | | | | |

| 40,069.870 | Pershing LLC | 3,399.9960 | 8.4926 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Merrill Lynch | 2,611.9940 | 6.5243 | % |

| | 4800 Deer Lake Drive East, | | | |

| | 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | LPL Financial | 32,785.8890 | 81.8937 | % |

| | 9785 Towne Centre Drive | | | |

| | San Diego, CA 92121-1968 | | | |

| |

| DGEIF (Class A) | | | | |

| 559,320.916 | UBS WM USA | 97,307.2010 | 17.3974 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Pershing LLC | 94,794.7630 | 16.9482 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Richard C. Thomas | 33,044.2400 | 5.9079 | % |

| | Murrysville, PA 15668-9480 | | | |

| |

| | American Enterprise | 207,618.6210 | 37.1198 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

S-19

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DGEIF (Class C) | | | | |

| 259,981.044 | UBS WM USA | 30,892.7920 | 11.8827 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Merrill Lynch | 196,585.6380 | 75.6154 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 22,264.5650 | 8.5639 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| DGEIF (Class I) | | | | |

| 825,423.404 | Pershing LLC | 448,490.5140 | 54.3346 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | Charles Schwab & Co. Inc. | 311,098.3740 | 37.6896 | % |

| | Reinvestment Account | | | |

| | Attn.: Mutual Funds | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| DIBF (Class A) | | | | |

| 36,233,929.071 | Citigroup Global Markets Inc. | 3,510,633.4860 | 9.7162 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

| |

| | UBS WM USA | 8,009,242.8740 | 22.1667 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley & Co. | 2,623,499.4220 | 7.2609 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Pershing LLC | 2,236,328.0350 | 6.1894 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | American Enterprise | 9,876,241.9960 | 27.3339 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

S-20

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DIBF (Class A)(cont’d) | | | | |

| | Charles Schwab & Co. Inc. | 3,043,490.2290 | 8.4233 | % |

| | Special Custody Account FBO Customers | | | |

| | Attn.: Mutual Funds | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| DIBF (Class C) | | | | |

| 9,472,198.718 | National Financial Services | 662,452.1880 | 7.0001 | % |

| | 82 Devonshire Street, G10G | | | |

| | Boston, MA 02109-3605 | | | |

| |

| | Citigroup Global Markets Inc. | 954,053.7760 | 10.0814 | % |

| | 333 W 34TH ST | | | |

| | New York, NY 10001-2402 | | | |

| |

| | UBS WM USA | 1,263,778.1960 | 13.3542 | % |

| | 499 Washington Blvd. | | | |

| | Jersey City, NJ 07310-1995 | | | |

| |

| | Morgan Stanley & Co. | 977,011.7920 | 10.3240 | % |

| | Harborside Financial Center Plaza 2 | | | |

| | 3rd Floor | | | |

| | Jersey City, NJ 07311 | | | |

| |

| | Merrill Lynch | 2,760,714.2120 | 29.1722 | % |

| | 4800 Deer Lake Drive East, 2nd Floor | | | |

| | Jacksonville, FL 32246-6484 | | | |

| |

| | First Clearing, LLC | 784,914.5470 | 8.2941 | % |

| | 10750 Wheat First Drive | | | |

| | Glen Allen, VA 23060-9243 | | | |

| |

| | American Enterprise | 768,525.1780 | 8.1209 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| DIBF (Class I) | | | | |

| 27,670,838.810 | National Financial Services | 6,879,631.5440 | 24.9168 | % |

| | 82 Devonshire Street, G10G | | | |

| �� | Boston, MA 02109-3605 | | | |

| |

| | Pershing LLC | 1,637,117.2830 | 5.9293 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

S-21

| | | | | |

| | Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| | of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| | DIBF (Class I)(cont’d) | | | | |

| | | Merrill Lynch | 4,253,365.5120 | 15.4049 | % |

| | | 4800 Deer Lake Drive East, | | | |

| | | 2nd Floor | | | |

| | | Jacksonville, FL 32246-6484 | | | |

| |

| | | First Clearing, LLC | 3,103,864.7030 | 11.2416 | % |

| | | 10750 Wheat First Drive | | | |

| | | Glen Allen, VA 23060-9243 | | | |

| |

| | | SEI Private Trust Co. | 6,429,765.7880 | 23.2874 | % |

| | | C/O M&T Bank | | | |

| | | Attn.: Mutual Fund Administrator | | | |

| | | One Freedom Valley Drive | | | |

| | | Oaks, PA 19456-9989 | | | |

| |

| D/LT-F: | | | | | |

| | DBMMMMF | | | | |

| | 75,082,977.105 | Boston & Co. | 63,310,326.0800 | 84.3205 | % |

| | | P.O. Box 534005 | | | |

| | | Pittsburgh, PA 15253-4005 | | | |

| |

| | DBNYMMMF | | | | |

| | 168,174,483.690 | Boston & Co. | 33,349,346.6500 | 19.8302 | % |

| | | P.O. Box 534005 | | | |

| | | Pittsburgh, PA 15253-4005 | | | |

| |

| | | Virginia Chen Tod | 11,438,366.1300 | 6.8015 | % |

| | | Scarsdale, NY 10583-3114 | | | |

| |

| | DBCMMMF | | | | |

| | 88,671,767.180 | Boston & Co. | 58,961,487.8000 | 66.4941 | % |

| | | Mellon Bank Center | | | |

| | | Pittsburgh, PA 15259-0001 | | | |

| |

| | | Chinyol & Donna Family Trust & | 7,294,201.9300 | 8.2261 | % |

| | | Donna Yi Trustee | | | |

| | | Chinyol & Donna Family Trust & | | | |

| | | Newport Beach, CA 92660-5213 | | | |

| |

| | | ABKO Trust | 5,211,882.0600 | 5.8777 | % |

| | | P.O. Box 6716 | | | |

| | | San Pedro, CA 90734-6716 | | | |

S-22

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| DIF: | | | | |

| D/TBCEMCEF (Class A) | | | | |

| 6,310.825 | American Enterprise | 3,246.3280 | 51.4406 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | Charles Schwab & Co. Inc. | 1,710.6110 | 27.1060 | % |

| | Special Custody Account FBO Customers | | | |

| | Attn.: Mutual Funds | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| D/TBCEMCEF (Class C) | | | | |

| 6,149.390 | American Enterprise | 479.5120 | 7.7977 | % |

| | Investment Services | | | |

| | 707 2nd Ave. South | | | |

| | Minneapolis, MN 55402-2405 | | | |

| |

| | Southwest Securities Inc. FBO | 5,140.5350 | 83.5942 | % |

| | Wayne H. Berkner & | | | |

| | Marie L. Berkner JTWROS | | | |

| | Dallas, TX 75250-9002 | | | |

| |

| D/TBCEMCEF (Class I) | | | | |

| 370,846.146 | SEI Private Trust Company | 89,596.8360 | 24.1601 | % |

| | C/O The Bank of New York Mellon | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | Northern Trust as Custodian FBO | 83,547.4180 | 22.5289 | % |

| | Doris Duke Trust | | | |

| | Chicago, IL 60675-2994 | | | |

| |

| | BNY Mellon Corporation | 154,091.2450 | 41.5513 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| D/TBCLCCF (Class A) | | | | |

| 9,428.460 | The Bank of New York Mellon Custodian | 792.1490 | 8.4017 | % |

| | Bree D. Cocco | | | |

| | Roth IRA | | | |

| | Middletown, CT 06457-1793 | | | |

S-23

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| D/TBCLCCF (Class A)(cont’d) | | | | |

| | Lisa M. Keder Custodian | 1,248.9270 | 13.2464 | % |

| | Neal Keder Pohlman UGMA PA | | | |

| | Columbus, OH 43209-1871 | | | |

| |

| | Carole M. Miller Custodian | 5,485.4640 | 58.1799 | % |

| | Maude S. Plouvin UTMA MA | | | |

| | Andresy 78570 France | | | |

| |

| | BNY Mellon Corporation | 485.4370 | 5.1486 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| D/TBCLCCF (Class C) | | | | |

| 738.987 | American Enterprise | 253.5500 | 34.3105 | % |

| | Investment Services | | | |

| | P.O. Box 9446 | | | |

| | Minneapolis, MN 55440-9446 | | | |

| |

| | BNY Mellon Corporation | 485.4370 | 65.6895 | % |

| | MBC Investments Corporation | | | |

| | 100 White Clay Center Drive, Suite 102 | | | |

| | AIM #195-0100 | | | |

| | Newark, DE 19711 | | | |

| |

| D/TBCLCCF (Class I) | | | | |

| 749,860.118 | Christina D. Wood | 37,944.4710 | 5.0602 | % |

| | Dover, MA 02030-2112 | | | |

| |

| | SEI Private Trust Company | 367,001.1550 | 48.9426 | % |

| | C/O State Street Bank | | | |

| | Attn.: Mutual Funds Administrator | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | Dreyfus Moderate Allocation Fund | 47,455.5120 | 6.3286 | % |

| | The Dreyfus Corporation | | | |

| | Attn.: John Heinsohn | | | |

| | 200 Park Ave., 7th Floor | | | |

| | New York, NY 10166-0090 | | | |

S-24

| | | | |

| Name of Fund and Number | Name and Address of | Amount of | Percentage of | |

| of Shares Outstanding | Shareholder | Shares Held | Shares Held | |

| D/TBCLCCF (Class I)(cont’d) | | | | |

| | Charles Schwab & Co. Inc. | 142,831.1670 | 19.0477 | % |

| | Reinvestment Account | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

| |

| D/TBCSCGF (Class I) | | | | |

| 2,945,601.764 | National Financial Services Corp. | 504,705.9070 | 17.1342 | % |

| | For Exclusive Benefit of Our Customers | | | |

| | P.O. Box 3908 | | | |

| | Church Street Station | | | |

| | Attn.: Latayna Brown | | | |

| | New York, NY 10008-3908 | | | |

| |

| | Mitra & Co. FBO VA | 173,510.1100 | 5.8905 | % |

| | C/O M&I Trust Co. NA | | | |

| | 11270 West Park Place, Suite 400 | | | |

| | Milwaukee, WI 53224-3638 | | | |

| |

| | Texas Iron Workers’ Pension Plan | 233,874.1070 | 7.9398 | % |

| | 9555 W Sam Houston Pkwy South, Suite 400 | | |

| | Houston, TX 77099-2145 | | | |

| |

| | Wells Fargo Bank, NA FBO | 1,459,022.1630 | 49.5322 | % |

| | Thornton-RB | | | |

| | P.O. Box 1533 | | | |

| | Minneapolis, MN 55480-1533 | | | |

| |

| D/TBCSCTSEF (Class I) | | | | |

| 2,127,618.708 | Pershing LLC | 770,549.5430 | 36.2165 | % |

| | P.O. Box 2052 | | | |

| | Jersey City, NJ 07303-2052 | | | |

| |

| | SEI Private Trust Company | 305,509.2960 | 14.3592 | % |

| | C/O Ropes & Gray | | | |

| | Attn.: Mutual Funds Administrator | | | |

| | One Freedom Valley Drive | | | |

| | Oaks, PA 19456-9989 | | | |

| |

| | Charles Schwab & Co. Inc. | 602,616.9570 | 28.3235 | % |

| | Reinvestment Account | | | |

| | 101 Montgomery Street | | | |

| | San Francisco, CA 94104-4151 | | | |

S-25

| | | | |